However, the amount of up-front cash payments to suppliers is normally so small that this modification is not necessary. The cash payment exclusion may be necessary if a company has been so late in paying suppliers that they now require cash in advance payments. This ratio helps creditors analyze the liquidity of a company by gauging how easily a company can pay off its current suppliers and vendors. Companies that can pay off supplies frequently throughout the year indicate to creditor that they will be able to make regular interest and principle payments as well. The rules for interpreting the accounts payable turnover ratio are less straightforward. Beginning accounts payable and ending accounts payable are added together, and then the sum is divided by two in order to arrive at the denominator for the accounts payable turnover ratio.

Leveraging AP Automation to Improve AP Turnover Ratio

- Vendors want to make sure they will be paid on time, so they often analyze the company’s payable turnover ratio.

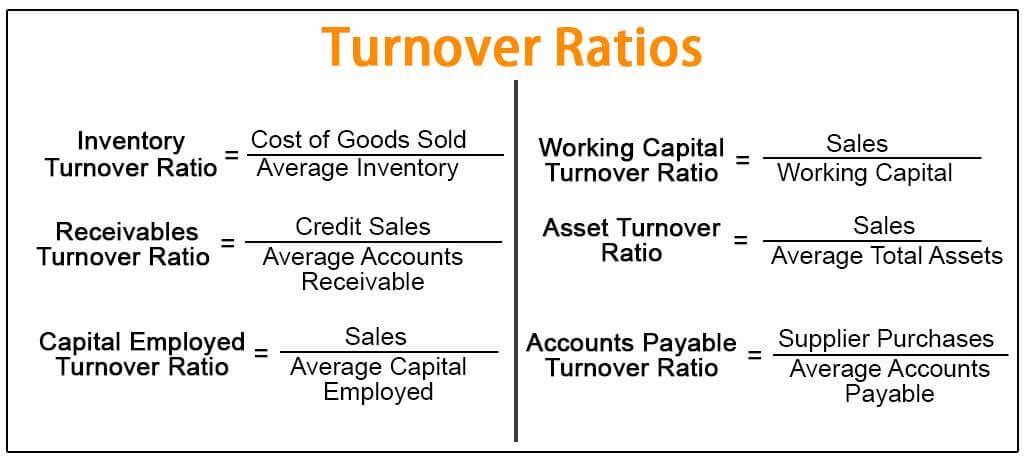

- The basic formula for the AP turnover ratio considers the total dollar amount of supplier purchases divided by the average accounts payable balance over a given period.

- Accounting professionals calculate accounts payable turnover ratios by dividing a business’ total purchases by its average accounts payable balance during the same period.

- If the cash conversion cycle lengthens, then stretch payables to the extent possible by delaying payment to vendors.

- Inconsistent accounting practices, errors in recording transactions, or changes in accounting policies can lead to fluctuations in the ratio, making it a less reliable indicator.

In that case, a decreasing ratio could show cash flow problems or financial distress. Both ratios provide valuable insights into a company’s financial health and, when used together, offer a more comprehensive view. Accounts payable analytics is useful for evaluating the efficiency of your company’s accounts payable process. A key metric used in accounts payable analytics is the AP turnover ratio, which measures how quickly a company pays off its suppliers and vendors. While businesses may have strategic reasons for maintaining lower accounts payables turnover ratios than cash on hand would show is necessary, there are other variables.

AP & FINANCE

A high accounts payable ratio signals that a company is paying its creditors and suppliers quickly, while a low ratio suggests the business is slower in paying its bills. This is a critical metric to track because if a company’s accounts payable turnover ratio declines from one accounting period to another, it could signal trouble and result in lower lines of credit. The AP turnover ratio is unique in that businesses want to show they can pay their bills on time, but they also want to show they can use their investments wisely.

Accounts Receivable vs Accounts Payable: What’s the Difference (With Examples)

This strategic decision may not necessarily reflect poor financial health but rather a cash management tactic. The AP turnover ratio is crucial for assessing a company’s ability to meet short-term liabilities. Typically, a higher ratio indicates better liquidity, suggesting efficiency in clearing dues to suppliers. Conversely, a lower ratio might point to cash flow issues or delays in paying suppliers.

The Formula for the Accounts Payable Turnover Ratio Is

And, if you start with an AP balance of $2,000 and end with an AP balance of $0, your average is still $1,000. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. You may check out our A/P best practices article to learn how you can efficiently manage payables and stay fairly liquid. The “Supplier Credit Purchases” refers to the total amount spent ordering from suppliers. That, in turn, may motivate them to look more closely at whether Company B has been managing its cash flow as effectively as possible.

Over time, your business can respond to new business opportunities and changing economic conditions. Improve cash flow management and forecast your business financing needs to achieve the optimal accounts payable turnover ratio. Compare the AP creditor’s turnover ratio to the accounts receivable how to design products with operations management in mind turnover ratio. You can compute an accounts receivable turnover to accounts payable turnover ratio if you want to. Are you paying your bills faster than collecting invoices from customer sales? If so, your banker benefits from earning interest on bigger lines of credit to your company.

High ratio suggests that the company manages its payables efficiently, often paying suppliers on time or even early to take advantage of discounts. Such efficiency is indicative of healthy cash flow, showing that the company has sufficient liquidity to meet its short-term obligations. Furthermore, a high ratio is often linked to strong supplier relationships, as consistent and timely payments can lead to more favorable terms and cooperation. Creditors and investors will look at the accounts payable turnover ratio on a company’s balance sheet to determine whether the business is in good standing with its creditors and suppliers. Higher figures indicate that a company pays its bills on a more timely basis, and thereby has less debt on the books.

A high ratio for AP turnover means that your company has adequate cash and financing to pay its bills. Measures how efficiently a company collects payments from its customers by comparing total credit sales to average accounts receivable. Before delving into the strategies for increasing the accounts payable (AP) turnover ratio, let’s understand the reasons behind the need for such adjustments. The total supplier purchase amount should ideally only consist of credit purchases, but the gross purchases from suppliers can be used if the full payment details are not readily available. Calculate the average accounts payable for the period by adding the accounts payable balance at the beginning of the period to the balance at the end of the period. It may be challenging for you to accurately measure the amount representing a company’s annual supplier purchases, since this figure isn’t always readily available in a firm’s financial statements.

The ideal AP turnover ratio should allow it to pay off its debts quickly and reinvest money in itself to grow its business. A higher ratio also means the potential for better rates on purchases and loans. However, an increasing ratio over a long period of time could also indicate that the company is not reinvesting money back into its business. This could result in a lower growth rate and lower earnings for the company in the long term. Because the turnover of payables is unique to each business type, you’ll gain the most valuable information for your investment analysis by comparing companies within the same industry. You should be aware, however, that an acceptable result for the payable turnover ratio varies from industry to industry.